ATTENTION: Business Owners, Entrepreneurs & Investors

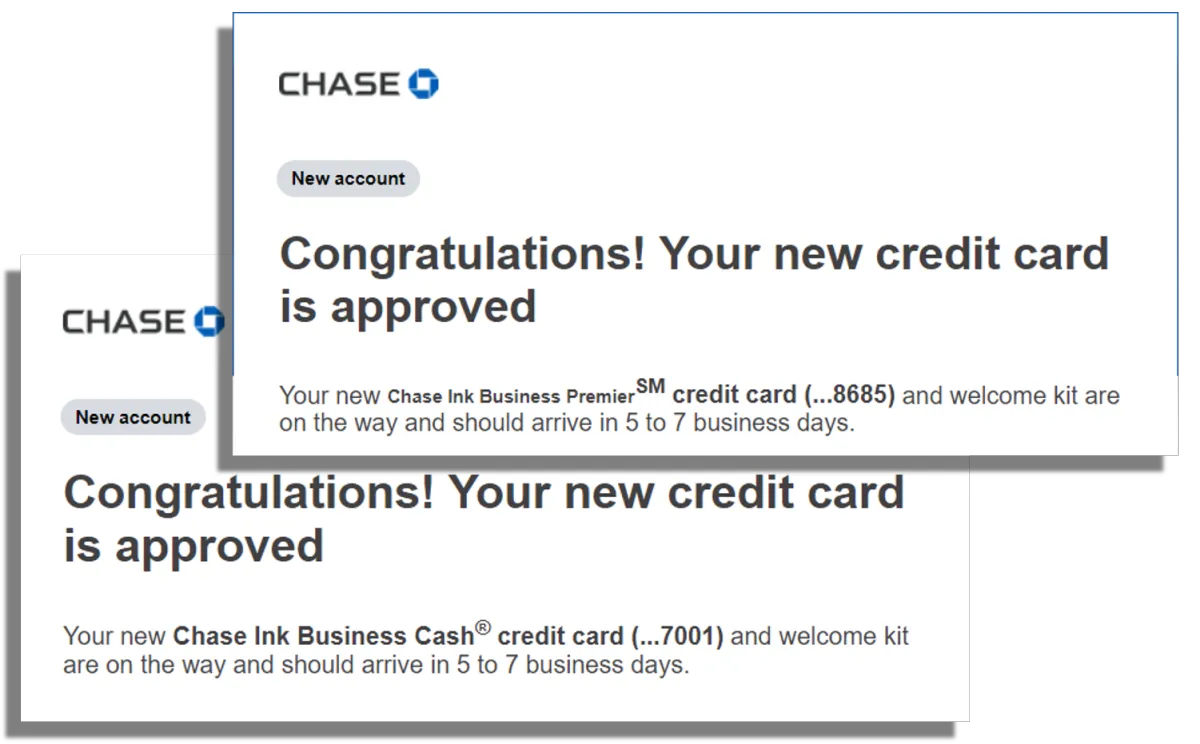

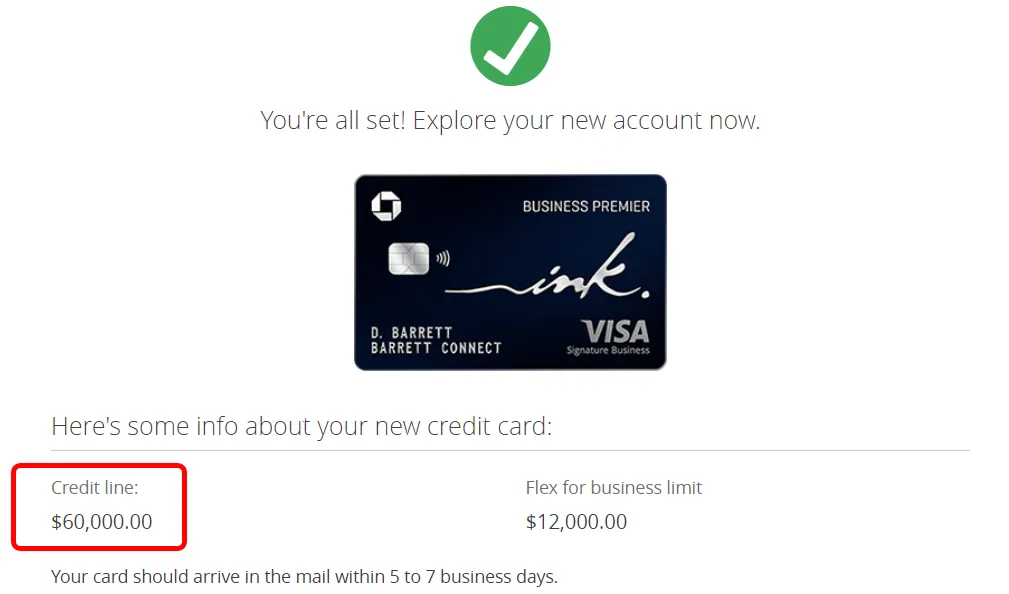

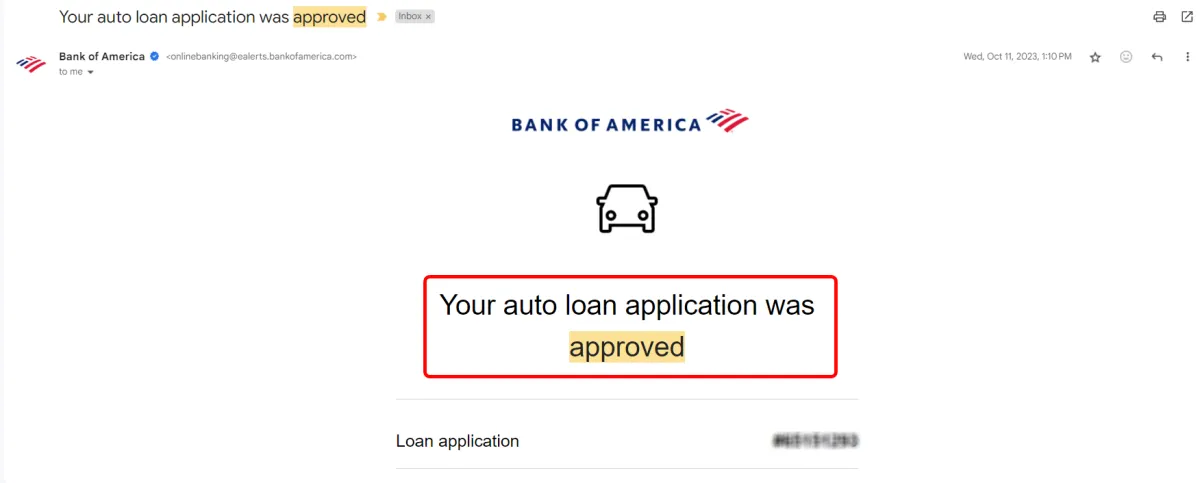

Get $50k - $150k+ In Business Funding With 0% Interest In 2025

Step 1: Watch the short video below

Step2: Fill out the short form to see if you qualify

By providing your email and phone number, you agree to receive marketing and update emails and SMS/text messages from Build&Fund. Message and data rates may apply. Reply "STOP" to unsubscribe or click the email opt-out link. View our Terms and Privacy Policy.

We are PERFORMANCE-Based and RESULTS-Driven

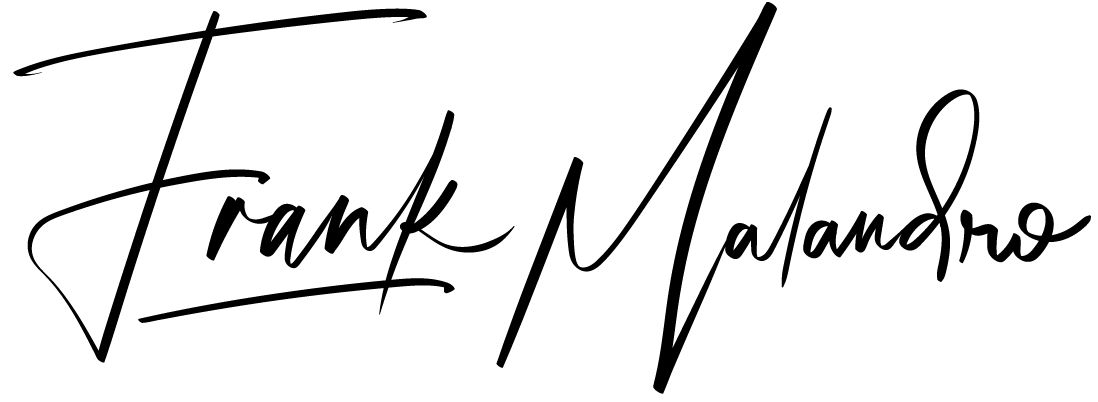

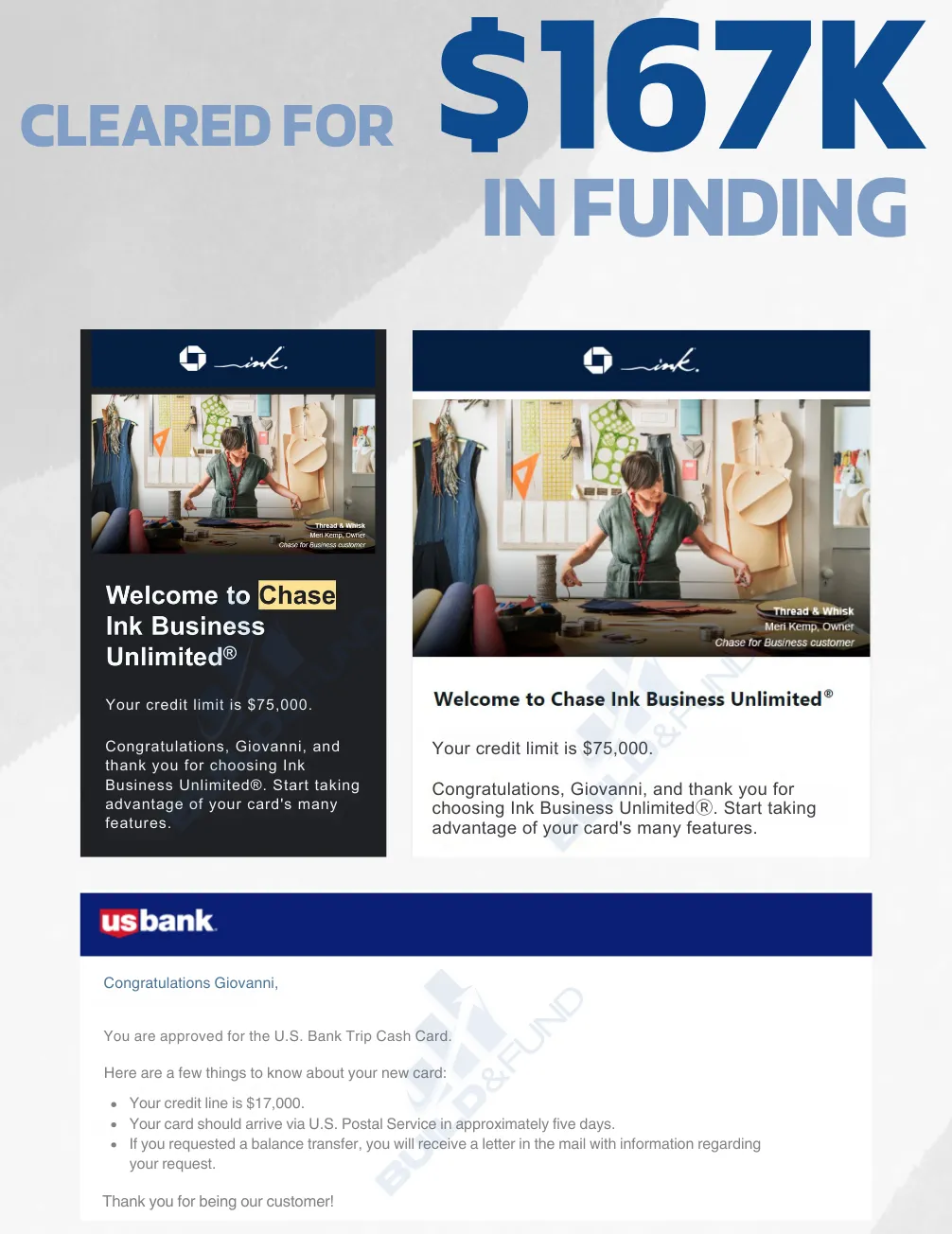

Some Of Our Recent COVID-Program Results...

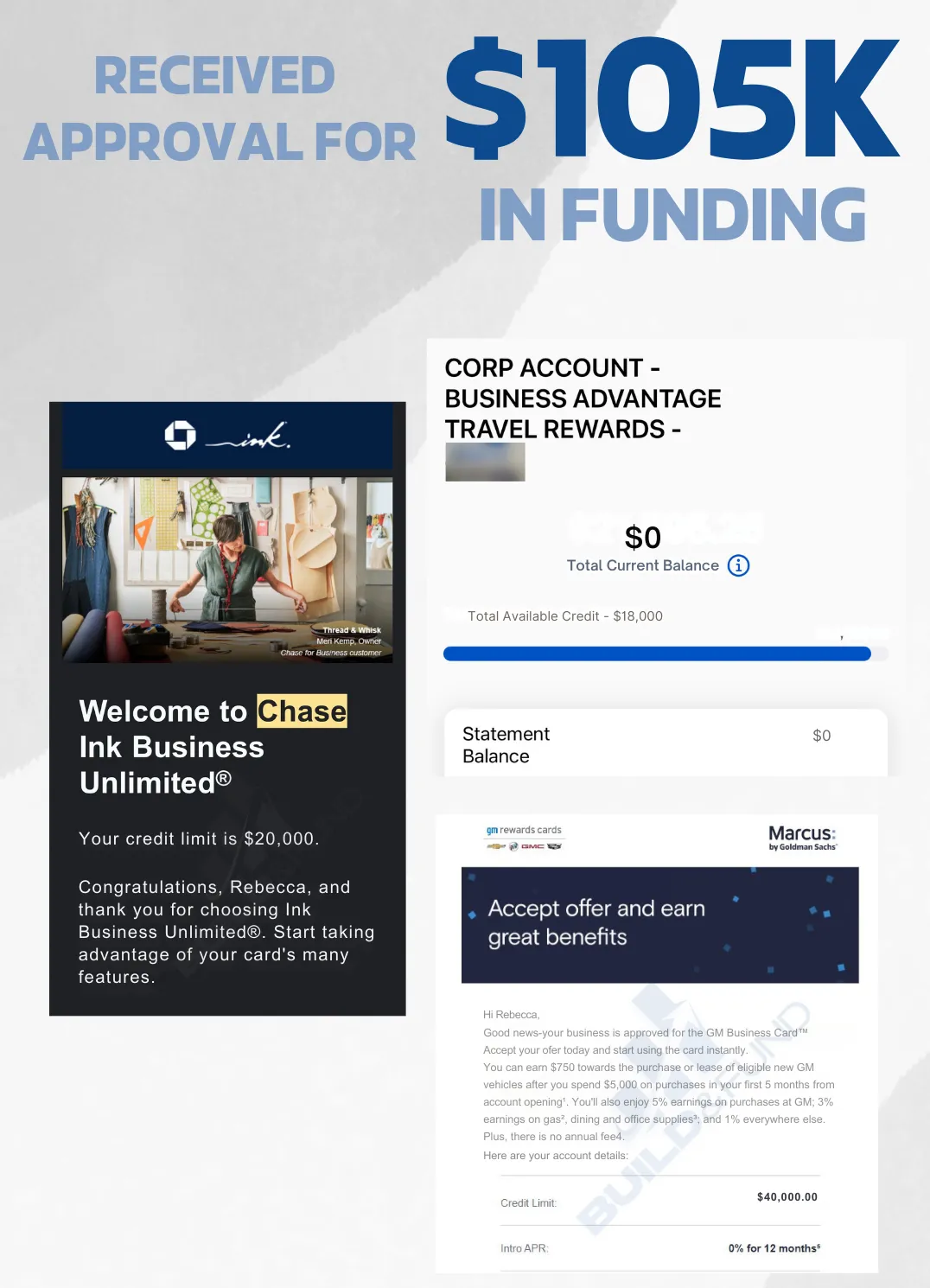

The New ROADMAP to Business FUNDING

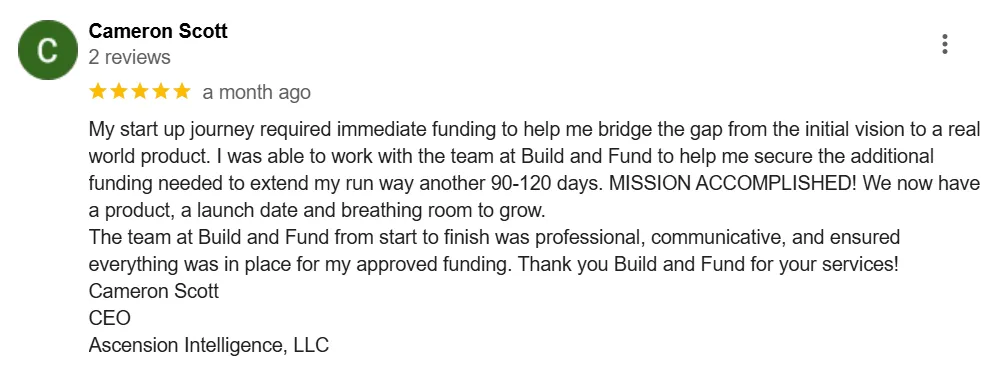

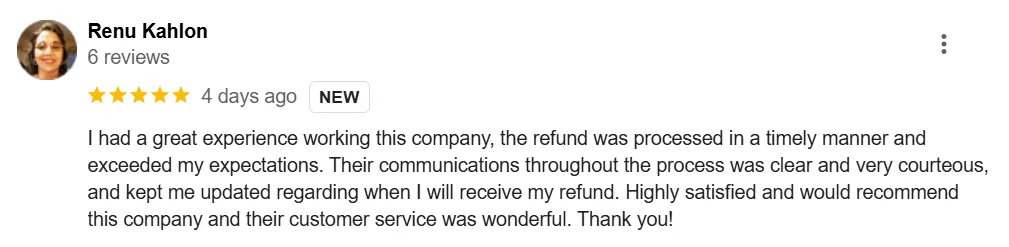

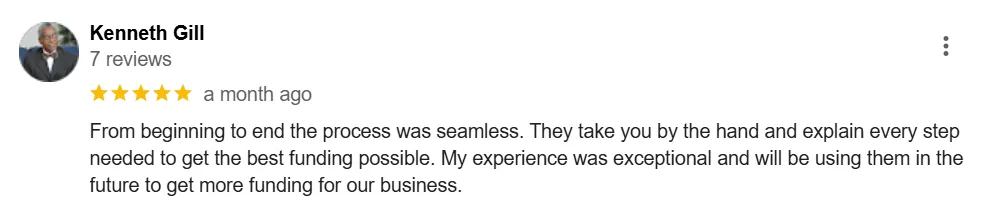

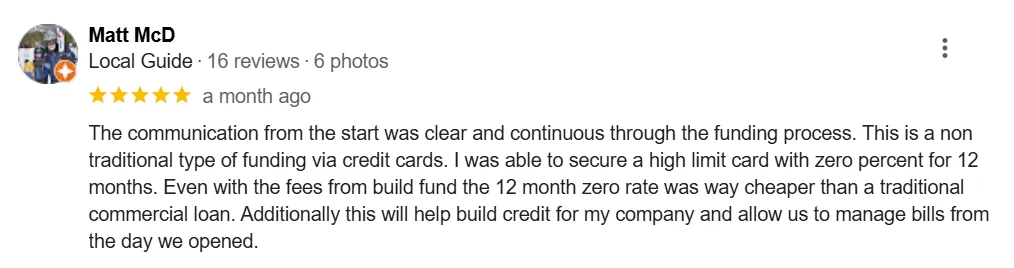

SEE What Our Clients Have to Say About Our Results

What Our Clients Have to Say About Our Results

A STRATEGIC Plan for EXPONENTIAL Approvals

Meet Frank Malandro, Public Service

to Profitable Entrepreneur

Meet Frank Malandro, Public Service to Profitable Entrepreneur

CEO & Co-Founder

Frank's journey from "Public Service to Profitable Entrepreneur" is based on determination and resilience. He transitioned from the security of a government job to pursuing his dream of entrepreneurship, and it was far from an easy path. Countless hours were spent late nights with just a laptop, and sleepless nights were a common occurrence as he went all in on the world of business and finance.

Through hard work, dedication, and an unwavering commitment to learning the intricacies of the funding game, Frank achieved what seemed impossible. He gained access to the vast capital resources necessary to fund multiple startup businesses, each making a significant impact in their respective industries.